|

CITY COMMISSION AGENDA ITEM |

|

|

Department: |

MSO |

Commission Meeting Date: December 4, 2018 |

|||||

|

Staff Contact: |

Charles Soules, Assistant Director of MSO |

||||||

|

Recommendations/Options/Action Requested: |

|||||||

|

Conduct public hearing for the purpose of hearing written and oral objections to the maximum amount of special assessments to be levied against properties in the Queens Road benefit district and the 6th and Queens Road intersection benefit district.

Pending City Commission discussion adopt on second and final reading, Ordinance No. 9607, levying the assessments. |

|||||||

|

Executive Summary: |

The City Commission has received public comment on the formation of the benefit districts for Queens Road and the formation of a benefit district for intersection improvements at 6th and Queens Road on four separate occasions: June 6, 2018, May 1, 2018, September 4, 2018, and October 2, 2018.

On October 2, 2018, the Commission adopted Resolution No. 7267 creating two benefit districts. One benefit district will finance the improvements to Queens Road from 6th Street to Eisenhower Drive, and the other will finance the intersection and signalization improvements at 6th Street and Queens Road.

In order to levy the special assessments authorized by Resolution No. 7267, the Commission must determine the cost of the improvements, prepare an assessment roll, direct the City Clerk to give notice of the proposed assessments through publication in the Lawrence Journal World and mailed notice to each property owner, conduct a public hearing on the proposed assessment amounts, and adopt an ordinance formally levying the special assessments against the properties in the benefit districts.

The statement of maximum costs, assessment roll, notice of public hearing, and Ordinance No. 9607 set the maximum amount of special assessments to be levied against the properties in the benefit districts. If the projects come in under budget, the City is obligated by state law to decrease the amount of the assessments to an amount equivalent to the total actual costs of the improvements.

Ordinance No. 9607 provides that the City will give property owners notice of the total final amount of assessments (in an amount not to exceed the maximum assessment) once the improvements are complete. At that time, property owners will be given a 30-day period during which they may choose to pre-pay all or a portion of those special assessments. If the assessment amount is not paid in full, then it will be levied in 10 annual installments, together with interest. The assessment amounts will appear on the owners’ property tax bills, and be collected in the same manner as other property taxes.

Currently, the City expects the project to begin in 2019, if the project is completed prepayment notices to property owners will be mailed in mid-to late 2019. If special assessments are not prepaid during the prepayment period, the City expects that the first levy of special assessments will appear on property tax bills in December 2020.

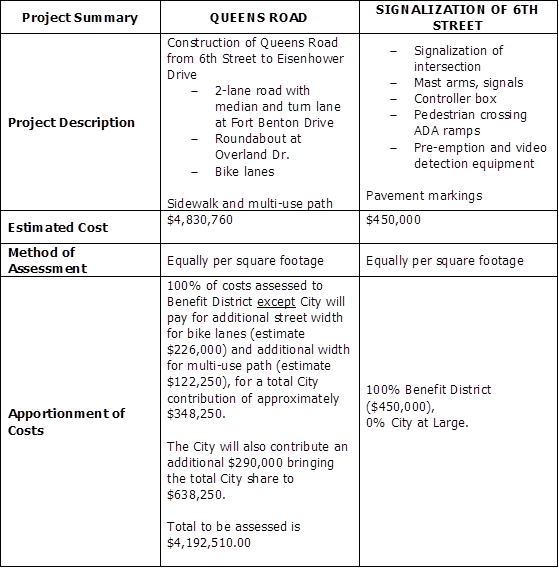

Following are the project and benefit districts summaries.

|

||||||

|

Strategic Plan Critical Success Factor |

Innovative Infrastructure and Asset Management

|

||||||

|

Fiscal Impact (Amount/Source): |

These projects are included in the 2018 Budget and CIP. The project is budgeted as follows:

|

||||||

|

Attachments: |

Exhibit A: Statement of Maximum Costs Exhibit C: Notice of Public Hearing Exhibit D: Sample Letter to Property Owners Queens Road benefit district area 6th and Queens Road benefit district area

|

||||||

|

Previous Agenda Reports |

June 6, 2017 Regular Agenda #1 Conduct public hearing regarding a benefit district for 6th Street and Queens Road and consider adopting Resolution No. 7209, establishing the benefit district and ordering the improvements to the intersection of 6th Street and Queens Road. Staff Memo & Attachments

May 1, 2018, Regular Agenda #2 Provide direction on the formation of a benefit district for Queens Road and the signalization of the intersection of 6th Street and Queens Road. Direct staff to begin annexation of 1677 E. 1000 Road. Annexation Request Staff Memo

September 4, 2018, Regular Agenda #3 Adopt Resolution No. 7263, establishing October 2, 2018 as the public hearing date for the formation of a benefit district for the construction of Queen’s Road and the formation of a benefit district for the signalization of 6th Street and Queen’s Road, if appropriate. Staff Memo & Attachments

October 2, 2018, Regular Agenda #2 Conduct public hearing and adopt Resolution No. 7267, establishing the benefit districts and ordering the improvements to be completed, if appropriate. Staff Memo & Attachments |

||||||

|

(for CMO use only) |

☐TM ☐DS ☐CT ☒BM |