|

CITY COMMISSION AGENDA ITEM |

|

|

Department: |

City Managerís Office |

Commission Meeting Date:† Dec. 6, 2016 |

|||

|

Staff Contact: |

Diane Stoddard, Assistant City Manager |

||||

|

Recommendations/Options/Action Requested: |

|

||||

|

Approve first reading of Ordinance No. 9321 authorizing the issuance of an additional $2 million in Industrial Revenue Bond financing for Peaslee Tech in order for it to access a sales tax exemption on construction materials and equipment for the building and approve waiver of the IRB application fee.† |

|

||||

|

Executive Summary: |

In 2015, the City of Lawrence authorized IRBs for Peaslee Tech for the purpose of providing them a sales tax exemption for construction materials and equipment utilized in the renovation of the building for the technical school.† While the resolution of intent to issue the bonds was authorized for $3.2 million, the bonds were issued in the amount of $1.2 million, which was the amount identified at the time as the most immediate projects to be funded.† Peaslee Tech has identified additional construction activities and equipment that would benefit from a sales tax exemption. Peaslee Tech is also requesting a waiver of the Cityís IRB application fee.†

Peaslee Tech is a non-profit technical training center that is a partnership of the Lawrence Chamber of Commerce, the EDC, the City of Lawrence, Douglas County, and others.†

Staff recommends approval of the Industrial Revenue Bond ordinance for Peaslee Tech and waiver of the IRB application fee.† Peaslee Tech will be responsible for bond issuance costs.†

|

||||

|

Strategic Goal Area: |

Economic Development |

||||

|

Fiscal Impact (Amount/Source): |

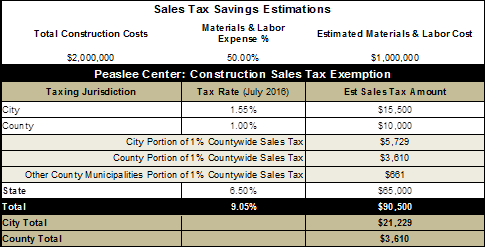

The fiscal impact to the City is an estimated $21,229 in sales tax related to construction materials and equipment purchases forecast by Peaslee Tech.† |

||||

|

Attachments: |

Letter of Request from Peaslee Tech |

||||

|

Reviewed By: (for CMO use only) |

☐TM ☒DS ☐CT ☐BM |