Memorandum

City of Lawrence

City Manager’s Office

|

TO: |

Thomas M. Markus, City Manager |

|

CC: |

Diane Stoddard, Assistant City Manager Casey Toomay, Assistant City Manager |

|

FROM: |

Britt Crum-Cano, Economic Development Coordinator |

|

DATE: |

March 18, 2016 |

|

RE: |

Bond Ordinance for 800 New Hampshire Street Industrial Revenue Bond Issuance |

Background

The 800 New Hampshire redevelopment project will include a four-story, apartment addition above the existing, street-level building (formerly Pachamama’s restaurant). Plans call for the existing building to remain retail/restaurant space and the upper floors to consist of approximately 50-55 multi-family units and a partial roof-top terrace.

In 2015, the project developer requested Industrial Revenue Bonds (IRB) in order to obtain a sales tax exemption on project construction materials. On December 1, 2015, the City Commission adopted Resolution No. 7135, determining the intent of the City to issue taxable industrial revenue bonds up to $7,800,000 to finance the cost of acquiring, constructing and equipping a commercial facility for the benefit of 800 New Hampshire, LLC and its successors with the condition that the project meets LEED requirements and the developer contribute $75,000 to the City of Lawrence Housing Trust Fund.

As required by Resolution No. 7135, the City received $75,000 on March 8, 2016 in payment from the project developer as contribution to the Housing Trust Fund. Evidence of the project meeting LEED requirements will be due from the Developer after project completion.

About Industrial Revenue Bonds

Industrial Revenue Bonds (IRBs) are an incentive established by the State of Kansas to enhance economic development and improve the quality of life. Considered a “conduit financing mechanism” whereby the City can assist companies in acquiring facilities, renovating structures, and purchasing machinery and equipment through bond issuance, IRBs can be useful to companies in obtaining favorable rate financing for their project, as well as providing a sales tax exemption on project construction materials.

IRBs are repayable solely by the company receiving them and place no financial risk on the City. When IRBs have been issued, the municipality owns the underlying asset and the debt is repaid through revenues earned on the property that have been financed by the bonds. If the company defaults, the bond owners cannot look to the city for payment.

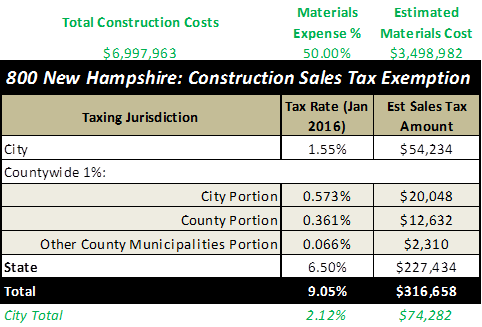

Estimated Sales Tax Savings

The costs of incentives are restricted to a sales tax exemption on construction materials for the project. Staff recently updated the projections for sales tax savings on the construction materials based upon January 2016 Kansas State sales tax rates. Below is a chart showing the savings broken out by jurisdiction. The State of Kansas by far is the largest factor in the overall sales tax savings because it has the highest sales tax rate.

|

Requested Action

Adopt on first reading, Ordinance No. 9210, authorizing the issuance of up to $7.8 million in industrial revenue bonds (IRBs) and authorize the Mayor to execute the necessary bond documents for the 800 New Hampshire redevelopment project.