Memorandum

City of Lawrence

City Managerís Office

|

TO: |

David L. Corliss, City Manager |

|

FROM: |

Britt Crum-Cano, Economic Development Coordinator |

|

DATE: |

April 3, 2014 |

|

CC:

|

Diane Stoddard, Assistant City Manager, Cynthia Wagner, Assistant City Manager |

|

RE: |

Clarification of Measurement Periods for Grandstand Tax Abatement Compliance Reporting |

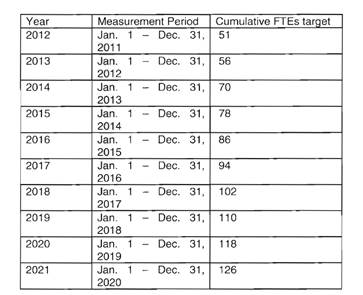

Compliance reporting for Grandstand is proving cumbersome and confusing on the part of both the City and Grandstand due to the measurement periods for job creation as specified within the performance agreement.† This was illustrated in the 2012 Compliance report when Grandstand reported a shortage for 2012 as job creation compliance for that year was based on the January-December 2011 measurement period.† Grandstand had 45 full-time jobs during the 2011 measurement period compared to a target of 51 as specified within the agreement for the first abatement year (2012).† In fact, Grandstand had 71 full-time jobs in 2012, far exceeding the job creation target for the first year of the tax abatement.

Below are the measurement periods for job creation as specified within the performance agreement (Section 5b):

|

|

Staff proposes a clarification of the compliance schedule, through mutual agreement between the City and Grandstand, which would tie the compliance measurement period to its corresponding tax year.† Note this does not affect targets or total job creation numbers, but rather makes compliance calculation and reporting more efficient and straightforward for both the City and Grandstand.†

Below is a proposed compliance schedule, aligning all reporting requirements to the measurement period corresponding to the tax year that the abatement is applied.

|

Grandstand: Compliance Schedule |

|||||||

|

Abatement Year |

Year Taxes Levied |

Measurement Period |

Performance Agreement Targets |

||||

|

Cumulative FTEs |

Average Company Wage |

Wage Floor |

Cumulative Capital Investment (as of December 31st) |

% FTEs meeting Health Care Coverage Minimums |

|||

|

n/a |

2011 |

January 1 - December 31, 2011 |

n/a |

n/a |

n/a |

n/a |

n/a |

|

1 |

2012 |

January 1 - December 31, 2012 |

51 |

$14.00 |

$11.93 |

$4,820,000 |

100% |

|

2 |

2013 |

January 1 - December 31, 2013 |

56 |

$14.28 |

$12.21 |

$4,820,000 |

100% |

|

3 |

2014 |

January 1 - December 31, 2014 |

70 |

$14.57 |

$12.37 |

$4,840,000 |

100% |

|

4 |

2015 |

January 1 - December 31, 2015 |

78 |

$14.86 |

TBD |

$4,840,000 |

100% |

|

5 |

2016 |

January 1 - December 31, 2016 |

86 |

$15.15 |

TBD |

$4,890,000 |

100% |

|

6 |

2017 |

January 1 - December 31, 2017 |

94 |

$15.46 |

TBD |

$4,890,000 |

100% |

|

7 |

2018 |

January 1 - December 31, 2018 |

102 |

$15.77 |

TBD |

$4,915,000 |

100% |

|

8 |

2019 |

January 1 - December 31, 2019 |

110 |

$16.08 |

TBD |

$4,915,000 |

100% |

|

9 |

2020 |

January 1 - December 31, 2020 |

118 |

$16.40 |

TBD |

$4,940,000 |

100% |

|

10 |

2021 |

January 1 - December 31, 2021 |

126 |

$16.73 |

TBD |

$4,940,000 |

100% |

Recommended Action

Authorize the City Manager to sign a letter of understanding agreeing to the revised compliance schedule. As the 2013 report has been completed, this change will be reflected in the 2014 report.