Memorandum

City of Lawrence

Department of Administrative Services

|

TO: |

Dave Corliss, City Manager

|

|

FROM: |

Frank Reeb, Administrative Services Director Lori Carnahan, Personnel Manager Marlo Cohen, Personnel Specialist

|

|

CC: |

Debbie Van Saun Assistant City Manager

|

|

DATE: |

March 27, 2007

|

|

RE: |

2008 Health Plan Budget Proposal

|

I. Executive Summary.

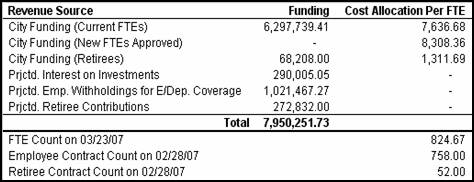

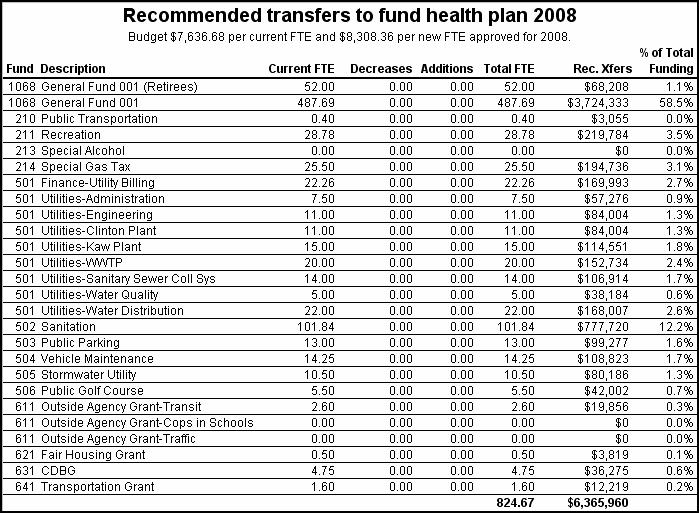

The level of funding recommended for the health plan during the 2008 benefit period is $7,950,251. We recommend annual City funding increase 6% ($360,336) over the 2007 level of funding or $6,365,947.41 in total. Each department should budget $7,636.68 per full-time equivalent (FTE) and $8,308.36 per new FTE approved for 2008 (increases over 2007 funding of $425.68 and $474.36, respectively). City funding per retiree contract should be $1,311.69 (a $27.31 decrease under 2007 funding) or $68,208 in total based on a 52 contract count.

|

|

We recommend that employee coverage remain fully funded by the City, and that employee withholdings for dependent coverage increase 6% from $181.00 per month to $191.86, i.e. $5.01 from $83.50 per pay period to $88.51.

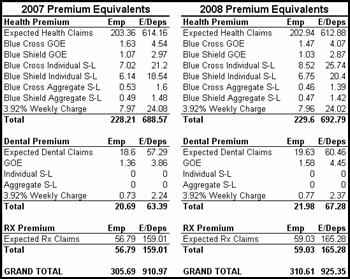

Our recommendation that retirees continue to pay 80% of the monthly premium equivalent per contracts is subject to the pending results of the GASB 45 cost study. Preliminary premium equivalents indicate the following monthly rates.

|

|

II. Funding Based on Risk Analysis.

The recommended funding for the Health Plan during the 2008 benefit period was developed using risk analysis, and does not consider GASB 45 funding implications. (The GASB 45 cost study results and recommendations to be presented by EFI Actuaries in late March have the potential to significantly affect our recommendations.)

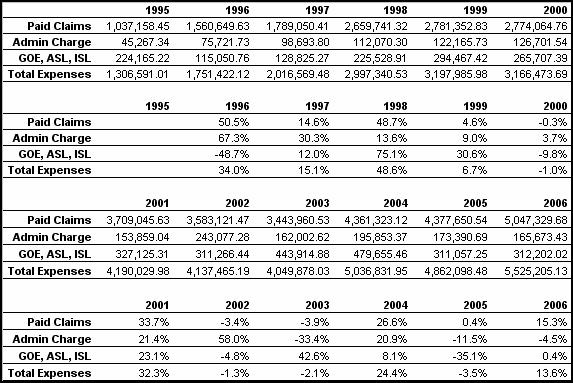

The goal of risk analysis is to determine a level of funding that will provide a 95% confidence level that the year-end health fund balance will be at or above the minimum retained earnings (MRE) level of 25% of projected claims for any given year. The data used in the risk analysis was obtained from the AS/400 accounting system and is actual expenses on a paid basis (claims, weekly claims processing charges, operating expenses, and stop-loss premiums). Data was obtained from 1995-2006.

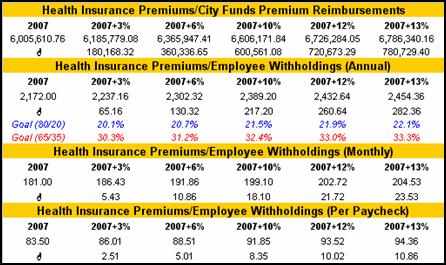

The conservative assumption for the annual increase to plan expenses (15.2%) was determined by averaging the percent change between consecutive years from 1995-2006 (see Attachment A). In the risk analysis, this assumption was carried forward through plan year 2013. Four additional funding strategies were developed in addition to the current 3and1 strategy of an annual contribution increase to city funding of 3% and employee withholdings for dependent coverage of 1%.

The 3and1 strategy developed by risk analysis in 2005 for the 2006 plan year was not projected to reach MRE until 2010. This strategy assumed an annual increase to plan expenses of 7%, based on Blue Cross and Blue Shield of Kansas (BCBSKS) average trend for their book of business in 2005, rather than the Health Plans actual trend. A 3% increase over the 2007 level of funding is $180,168.32 or $6,185,779.08 in total. However, as the current risk analysis projects the 3and1 strategy will reach MRE mid-year 2009, we do not recommend proceeding with it for the 2008 benefit period. Risk analysis has been utilized to assist us in managing the Health Plan such that annual funding increases may remain incremental. Using the 3and1 strategy could negate the benefit of risk analysis and place the Health Care Committee in the position of having to recommend large annual funding increases from stakeholders.

Again, assuming a conservative increase to annual plan expenses, four additional strategies (6and6/2010, 10and10/2011, 12and12/2012, and 13and13/2013) were developed to present funding options that may delay reaching MRE until 2010, 2011, 2012 or 2013. The same annual contribution increases were applied to city funding and employee withholdings for each strategy to remain equitable. Therefore, the 6and6/2010 funding strategy requires a 6% increase in contributions from annual city funding and employee withholdings and projects reaching MRE in 2010, etc. The strategies are summarized in the following graph and chart.

|

|

|

|

III. Health Plan Funding.

Although MRE could be reached as early as 2010, and despite the fact that 58 new contracts were added in 2007, we are in favor of recommending the 6and6/2010 funding strategy for the 2008 benefit period. This is partially due to conservative assumptions in the risk analysis. Also, during meetings this summer, the Health Care Committee will strongly consider increasing 2008 out-of-pockets costs for both the major medical and prescription drug programs to place us more in alignment with the majority of like contracts held by BCBSKS and MedTrak Pharmacy Services. The last increase to out-of-pocket costs occurred January 1, 2002. Finally, BCBSKS presented our 2008 contract renewal on March 19, 2007 at an estimated annual 1.1% increase in total plan costs. MedTrak projected a preliminary annual 10% increase in prescription drug claims. Preliminary estimates of premium equivalent increases are currently 1.6%.

|

|

In 2007, annual city funding for the health plan is $6,005,610.76. With the recommended 6% increase, annual funding in 2008 would be $6,365,947.41 (a $360,336.65 increase).

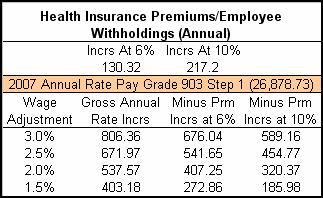

In 2007, annual employee withholdings for dependent coverage per contract total $2,172.00. With the recommended 6% increase, annual withholdings in 2008 would be $2,302.32. On a per pay period basis, the withholding would increase $5.01 from $83.50 to $88.51. Calculations projecting the net effect of this increase on various wage adjustments (without taking into consideration the pre-tax benefits of the withholdings) for employees in pay grade 903 and at step 1 are described in the table below. All scenarios resulted in an increase to net earnings.

|

|

At this time, we recommend that retirees pay 80% of the premium equivalent for their level of coverage. Again, GASB 45 funding implications could significantly affect this recommendation. The preliminary 2008 rates per month are $248.00 for single coverage (a $3 increase) and $740.00 for family coverage (an $11 increase).

We recommend that city funding for active employees and retained earnings be based on a full-time equivalent (FTE) basis by department or fund. Therefore, each department or fund should budget $7,636.68 per FTE (see Attachment B).

We recommend city funding on a per contract basis for retirees and new positions approved for 2008, or $1,311.69 and $8,308.36, respectively.

IV. Action Request.

Approve a 6% increase ($360,336.65) in annual city funding for the health plan totaling $6,365,947.41. This includes funding $68,208.00 toward retiree contracts.

Advise each department to budget $7,636.68 per current FTE and $8,308.36 for new FTEs approved for 2008.

Approve a 6% increase ($130.32) in annual employee withholdings for dependent coverage. The per pay period withholding would increase $5.01 from $83.50 to $88.51.

Approve preliminary monthly rates for retiree coverage ($248.00 for single, $740.00 for family).