City of Lawrence

Target Neighborhood Revitalization Plan

|

City of Lawrence Target Neighborhood Revitalization

Plan and Program

This Neighborhood Revitalization Plan (“Plan”) is required by the Kansas Neighborhood Revitalization Act (the “Act”) (see Appendix 1) in order to create a neighborhood revitalization area intended to encourage both reinvestment and improvements to a specific area or district of the community. The governing body of the City of Lawrence has determined that the Neighborhood Revitalization District (“District”) described in this Plan is a neighborhood revitalization area as described in K.S.A. 12-17,115(c).

The Governing Body has also determined that the rehabilitation, conservation, and redevelopment of the District is necessary to protect the public health, safety and welfare of the residents of the Neighborhood Revitalization District and the City as a whole, as required by K.S.A. 12-17,116.

In accordance with K.S.A. 12-17,117, the components of this Plan include:

1. A general description of the Plan’s purpose;

2. A legal description and map of the District;

3. The existing assessed valuation of the real estate comprising the District;

4. A list of names and addresses of the owners of record within the District;

5. The existing zoning classifications and District boundaries and the existing and proposed land uses within the District;

6. The proposals for improving or expanding municipal services within the District;

7. The term of the Plan;

8. The criteria used to determine what property is eligible for revitalization, including a statement specifying that property, existing buildings, and new construction is eligible for revitalization;

9. The contents, procedure and standard of review for an application for a rebate of property tax increments;

10. A statement specifying the maximum amount and years of eligibility for a rebate of property tax increments; and

11. A section regarding the establishment of a Neighborhood Revitalization Fund.

Section 1: Purpose

The vitality of the District plays a key role in the health and quality of life of the community. The City desires to establish a neighborhood revitalization tax rebate program (the “Program”) to provide incentives for property owners to invest in new development and redevelopment, and to build public and private infrastructure and to protect and revitalize historic properties. The Program is intended to revitalize the target neighborhoods and promote renewed investment, rehabilitation and conservation in residential and commercial properties in the District. The Program provides incentives for both residential and commercial property owners to improve their aging or deteriorating property, or otherwise increase the appraised value of the property. The Program is intended to promote the revitalization and development of residential and commercial properties by stimulating new construction and the rehabilitation, conservation, or redevelopment of the area in order to protect the public health, safety, or welfare of residents of the City.

The Program will provide a valuable incentive to private developers/property owners to redevelop the District and will accomplish important City priorities including, but not limited to, the following:

- Encourage the rehabilitation of historic structures;

- Encourage private parties to construct public infrastructure;

- Encourage housing, commercial, and industrial development in the City;

- Encourage the development of affordable housing;

- Stabilize mature neighborhoods;

- Expand the type and design of housing available in the City;

- Encourage the creation of jobs and employment in the City;

- Assist in reversing the outward migration of residents and the resulting deterioration of neighborhoods within a mature portion of the City;

- Strengthen community pride; and

- Create new long-term tax revenue, without creating a fiscal burden for the City, County, and other taxing jurisdictions.

Section 2: Legal Description & Map of Neighborhood Revitalization District

The District shall include all property included within the area described herein:

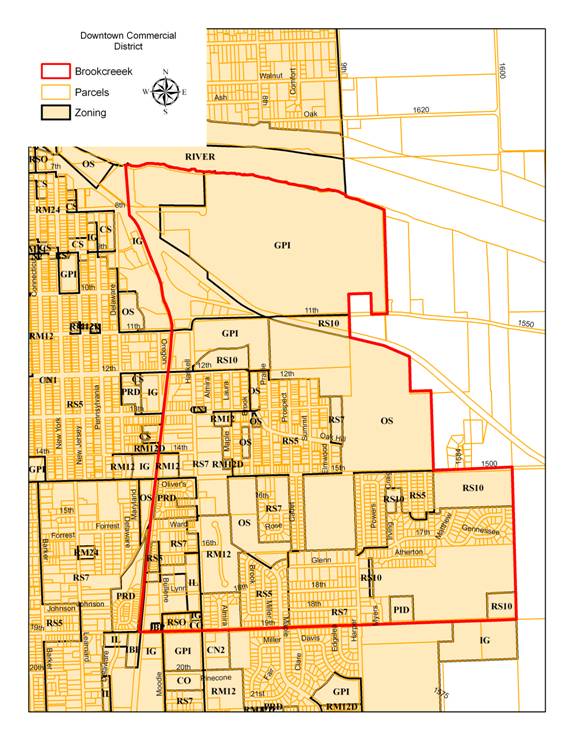

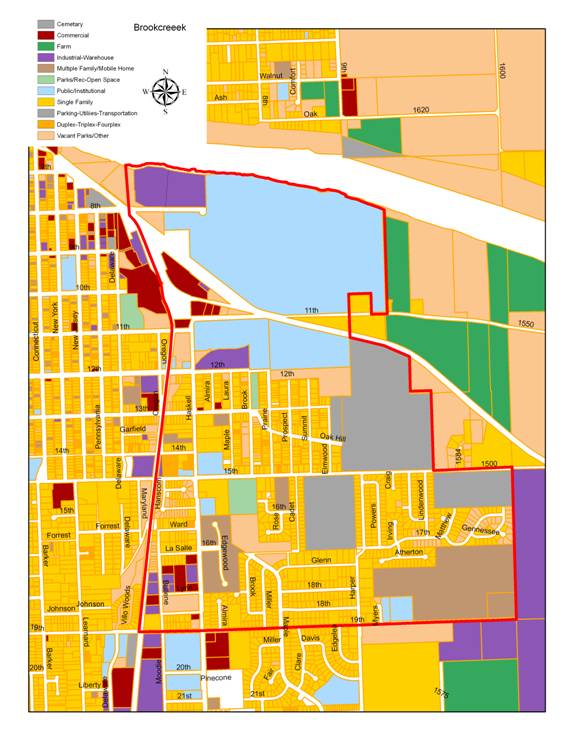

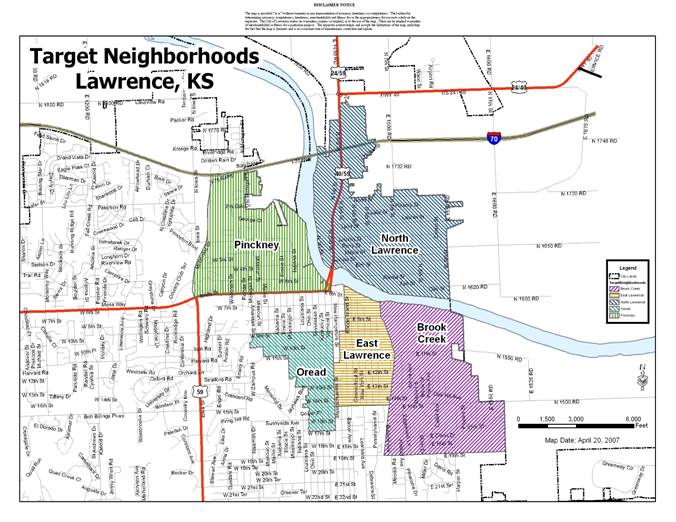

Brook Creek Neighborhood: That area of the City of Lawrence, Douglas County, Kansas, bounded on the east by the City Limits; on the north by the Kansas River; on the west by the Santa Fe Spur Line; and on the south by the north side of 19th Street to the City Limits, excluding Edgewood Homes.

Also:

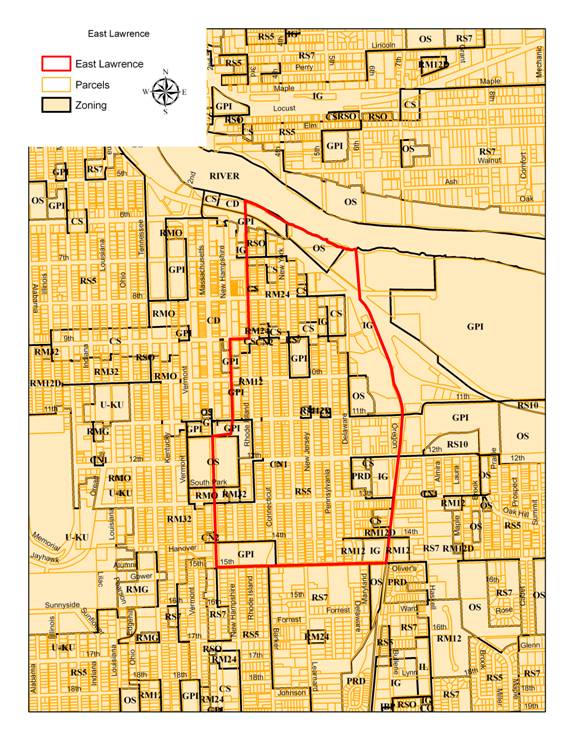

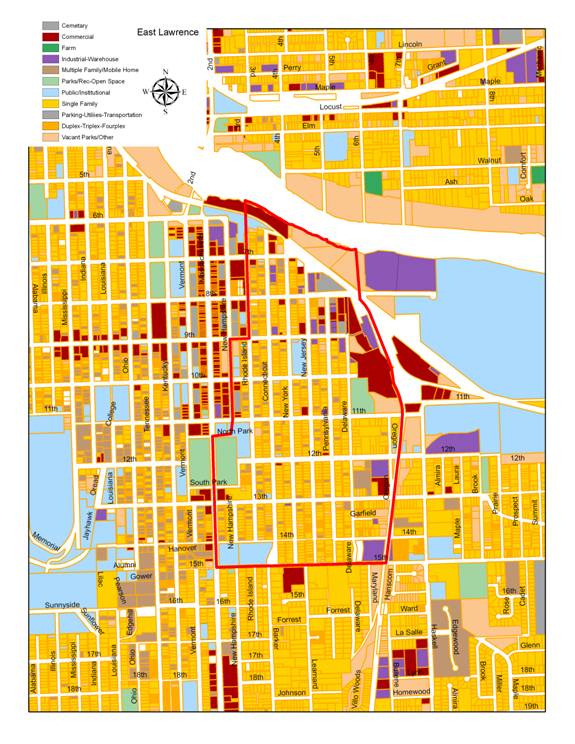

East Lawrence Neighborhood: That area of the City of Lawrence, Douglas County, Kansas, bounded on the North by the Kansas River; on the south by 15th Street and on the East by the Santa Fe Spur Line. The western boundaries are as follows: Rhode Island Street between the Kansas River and 9th Street; the alley behind New Hampshire Street between 9th and 11th Streets; Rhode Island Street between 11th and South Park Streets; and Massachusetts between South Park Street and 15th Street.

Also:

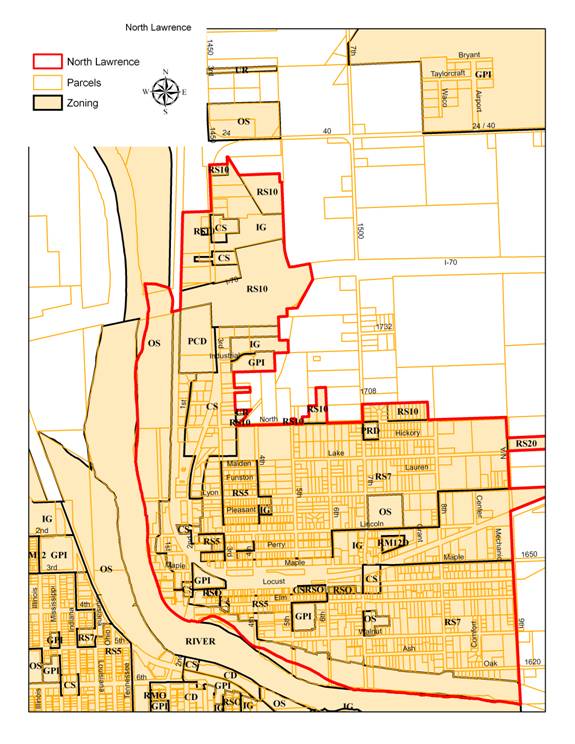

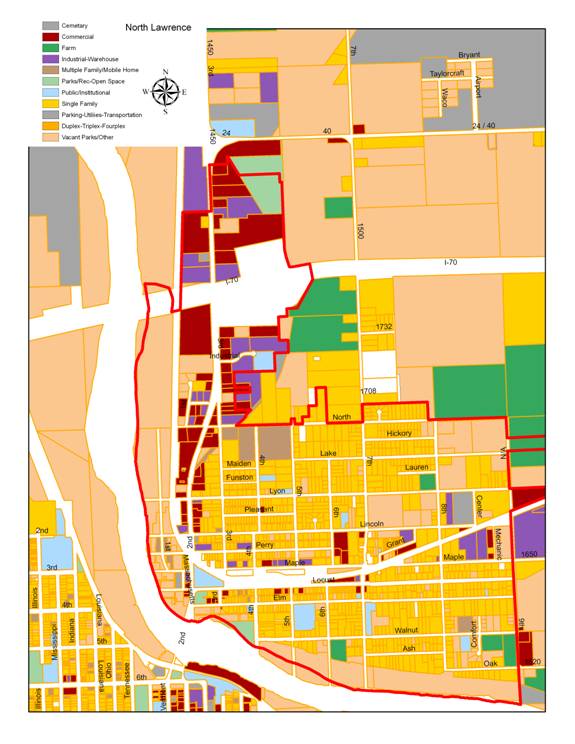

North Lawrence Neighborhood: That area of the City of Lawrence, Douglas County, Kansas, bounded on the north and east by the City Limits; on the south and west by the Kansas River.

Also:

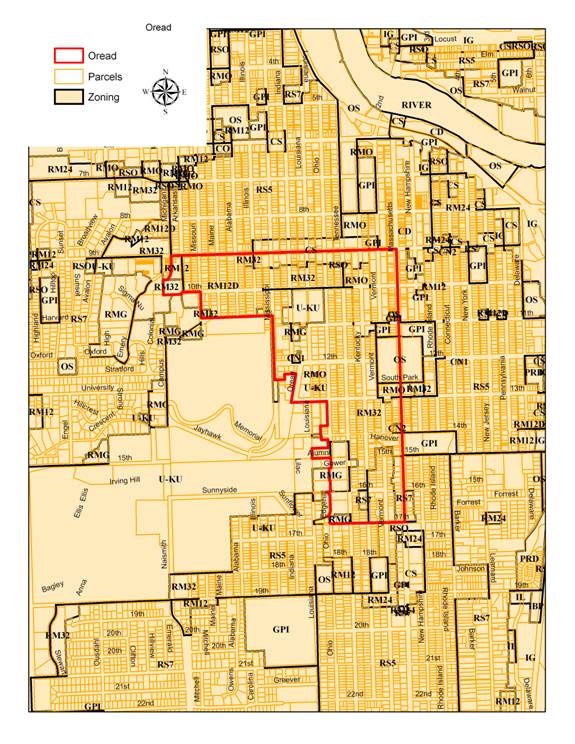

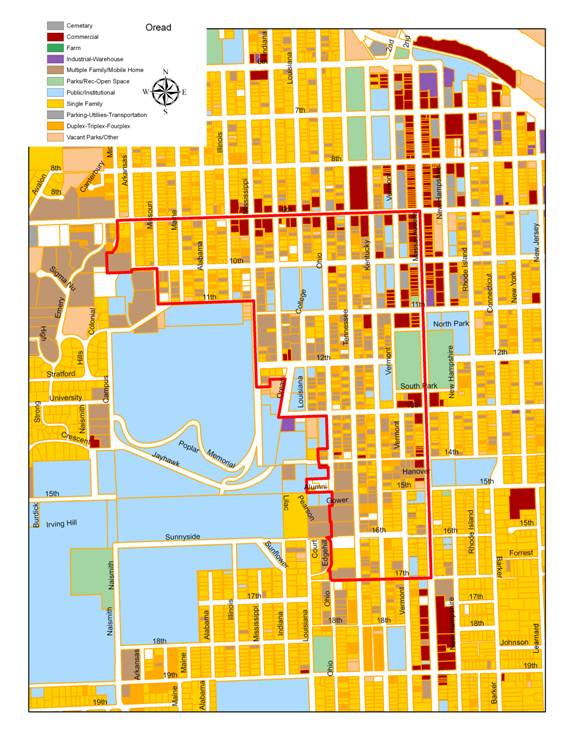

Oread Neighborhood: That area within the City of Lawrence, Douglas County, Kansas, which is bounded by Ninth Street on the north, Massachusetts Street on the east, Seventeenth Street on the south, Michigan Street on the northwest, the University of Kansas on the west to Gower Place, and the west boundary of the properties on the west side of Tennessee Street between 14th and 17th Streets.

Also:

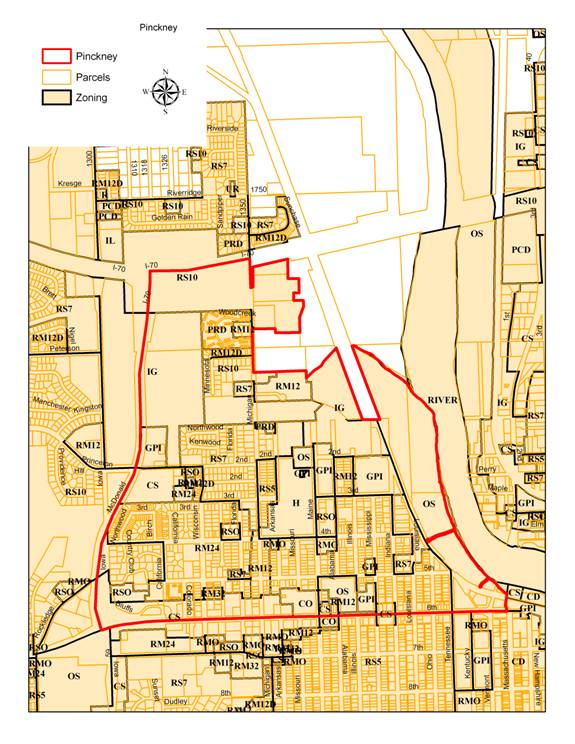

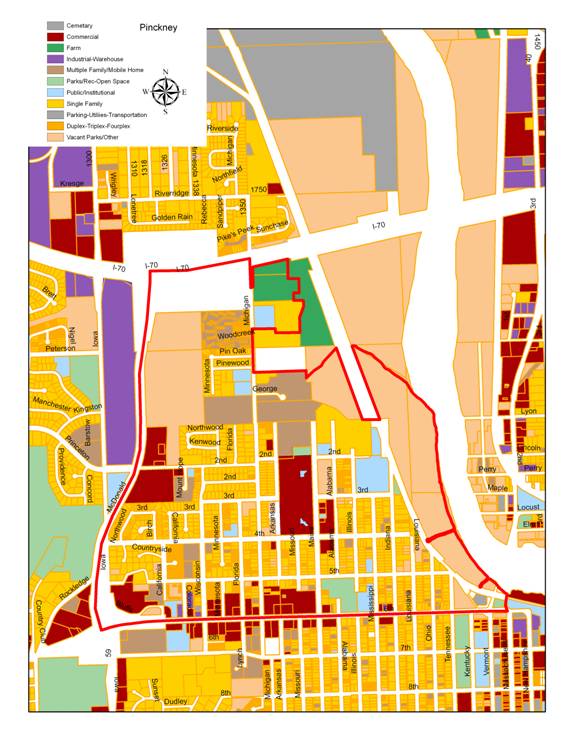

Pinckney Neighborhood: That area of the City of Lawrence, Douglas County, Kansas, bounded on the south by 6th Street; on the west by the West Interchange Road of the Kansas Turnpike; on the north by the Kansas Turnpike and the Kansas River; and on the east by Massachusetts Street.

As depicted below:

Section 3: Value of Real Properties

The total number of assessed parcels (2006) in the District is: 4,837

The 2006 appraised value of the real estate in the District is: $714,450,429

The 2006 assessed value of the real estate in the District is: $78,376,852

Section 4: Owners of Record in the Districts

A list of names and addresses of owners of record of real estate within the District are also available upon request from the City Clerk’s Office.

Section 5: Existing Zoning Classifications and District Boundaries; Existing and Proposed Land Uses

See Appendix II – Existing Zoning Maps.

See Appendix III – Existing Land Use Maps.

See Appendix IV – Future Land Use Map.

Section 6: Proposals for Improving Municipal Services in the District

The City recognizes the value of municipal services and capital improvements throughout the community. The City is strongly committed to maintaining a substantial presence in the Districts.

Efforts underway or in planning stages include:

Road Improvements as needed per the City’s annual mill and overlay program

Two Rivers/ Bourrough’s Creek Trail Improvements

Playground Improvements – ADA Accessibility

Intersection Upgrades

Sidewalk and Bike path installation

Water Main Improvements and Replacements

Sanitary Sewer Pumping Station Improvements (North Lawrence, 2007 completion)

Section 7: Term of the Plan

- This Plan and tax rebate Program shall be effective upon the adoption of this Plan by ordinance of the Governing Body of the City of Lawrence.

- This Plan and the District shall expire after two (2) years from the date of adoption unless extended by ordinance of the City Commission prior to its expiration. The City reserves the right to evaluate the Program at any time. The term of the tax rebate for applications approved under this Plan shall be pursuant to Section 10 herein.

3. The Governing Body may repeal, amend or modify this Plan as conditions, policies or priorities of the Governing Body change. If this Plan is repealed or the rebate criteria changed, any approved applications shall be eligible for rebates for the remaining Rebate Term originally provided in the Plan.

The Program is subject to approval of each taxing unit which will be stated in the interlocal agreement between the City and taxing jurisdictions. (See the City Clerk for taxing units who have adopted the Program.)

Section 8: Criteria used to Determine what Property is Eligible

- All property within the District, as such term is used in the Act, is eligible for Revitalization. Rehabilitation and additions to existing buildings or new construction or both is eligible for Revitalization (collectively “Improvements”). The Governing Body may consider a tax rebate for a property outside of the District eligible under the Plan, if it meets the requirements of K.S.A. 12-17,115 (c). Upon such finding, the Governing Body shall forward such declaration to the participating taxing entities for their consideration.

- Property used after the Improvements for single or multi-family residential uses is eligible for Revitalization. Property used after the Improvements for commercial or industrial uses is eligible for Revitalization. Mixed-use (both residential/commercial and residential/industrial) property is eligible for Revitalization.

- Property used after the Improvements for agricultural or any non-commercial, non-industrial or non-residential uses is not eligible.

- Property within a TIF Redevelopment District is not eligible for Revitalization. Property that has or will receive an ad valorem tax abatement, pursuant to other Kansas authority, is not eligible for Revitalization.

- As a result of the Improvements, the appraised valuation must increase by $10,000 for single family and two-family residential and by $10,000 for multifamily and commercial property. Improvements that do not increase the appraised valuation by the foregoing amounts will not be eligible for a property tax rebate.

- The Improvements must conform to all codes, rules, and regulations that are in effect at the time the Improvements are made. Improvements must be authorized by public improvement plans or building permit when applicable.

- Any otherwise eligible property with delinquent property taxes or special assessments shall not be eligible for a rebate until such time as all taxes and assessments have been paid.

- Property within the District that is also within the District established by the 8th & Pennsylvania Neighborhood Revitalization Plan or any other adopted Neighborhood Revitalization Plan, must comply with the requirements of the 8th & Pennsylvania Neighborhood Revitalization Plan and shall only be eligible for rebates under said 8th & Pennsylvania Neighborhood Revitalization Plan.

9. Property within the District that is also within the District established by the Downtown Commercial District Plan or any other adopted Neighborhood Revitalization Plan, must comply with the requirements of the Downtown Commercial District Plan and shall only be eligible for rebates under said Downtown Commercial District Plan.

Section 9: Contents of an Application for Rebate, Application Procedures and Standards of Criteria Used to Review an Application

1. Property owners of all eligible property will file an application with the City Clerk on application forms provided by the City. Applications will be provided by the Lawrence City Clerk, located at Lawrence City Hall, 6 East 6th Street, Lawrence KS 66044 or online at www.lawrenceks.org

2. Prior to the commencement of construction of any Improvements for which a tax rebate will be requested, the applicant-owner will complete Parts 1, 2 & 3 of the application. The property owner may appeal to the Governing Body and the Governing Body may approve an application for rebate after the commencement of construction of any Improvements but not later than when the substantially completed Improvements are first assessed by a Lawrence Building Official or designee.

3. Parts 1, 2 &3 of the application must be filed with the City Clerk with a refundable application fee ($25.00 single family residential and $100.00 multifamily residential or commercial) prior to the commencement of construction.

4. The City Clerk will forward a copy of Parts 1, 2 & 3 to the County Appraiser for notification and information purposes. Copies of the application will also be forwarded to the Planning and Development Services Department for monitoring purposes.

5. The Planning and Development Services Director or their designee, shall review all applications based on eligibility contained in this Plan. If the application is (i) complete (to the extent required at this point in the process), (ii) involves an eligible property and land use, and (iii) complies with all standards within the Act and this Plan; the Planning and Development Services Director or their designee shall approve such application.

6. The City will notify by letter to the applicant within thirty (30) days of receipt of Parts 1, 2 & 3 of the application, indicating approval or denial of the Application. If denied, the City will state the reason for the denial. If an application is not approved, the property owner may appeal the decision in writing to the Governing Body.

7. The applicant-owner will file Part 4 of the Application within 10-days after commencing construction of the Improvement. The City shall provide Part 4 of the Application to the County Appraiser.

8. For any Improvement that is completed on or before January 1 of the calendar year, following the commencement of construction, the owner-applicant will file Part 5 of the application with the City certifying the completion of construction, along with an itemized statement of costs. Part 5 of the Application will be filed on or before December 1 of the calendar year, preceding the commencement of the tax rebate period.

9. For any Improvement that is only partially completed as of January 1 of the calendar year, following commencement of construction, the owner-applicant will file Part 5 of the application with the City indicating the status of construction as of January 1 of the calendar year. Part 5 will be filed on or before December 15 of the calendar year, preceding the commencement of the tax rebate period.

10. The City shall provide Part 5 of the application to the County Appraiser.

11. Soon after January 1 of the calendar year, the County Appraiser will conduct an on-site inspection of the Improvements and determine the new valuation of the real estate accordingly. The valuation is then reported to the County Clerk by June 15 of the calendar year. The tax records will be revised.

12. Upon payment in full of the real estate tax for the subject property for the initial and each succeeding year period extending through the Rebate Term, and within an approximately thirty (30) day period following the date of tax distribution by the County to the other taxing units, a tax rebate in the amount of the Tax Increment (defined below) will be made to the owner or the person liable for payment of the taxes on the property or their assignee. If property tax is paid in semiannual payments, the rebate is made after payment of the second installment.

13. The tax rebate will be made by the Finance Director of Lawrence through the Neighborhood Revitalization Fund established in conjunction with the other taxing units participating in an Interlocal Agreement. If the property owner appeals their tax bill to County Appraiser, no payment will be made until the appeal is resolved.