Plan and Program

The

Neighborhood Revitalization Plan (“Plan”) is required by state statute (see

Appendix 1) in order to create a Neighborhood Revitalization Program intended

to encourage both reinvestment and improvements to a specific area or district

of the community. The

governing body of the City of

a) An area in which there is a predominance of buildings

or improvements by which reason of dilapidation, deterioration, obsolescence,

inadequate provision for ventilation, light air, sanitation, or open spaces,

high density of population and overcrowding, the existence of conditions which

endanger life or property by fire and other causes or a combination of such

factors, is conducive to ill health, transmission or disease, infant mortality,

juvenile delinquency or crime and which is detrimental to the public health,

safety or welfare;

b) An area which by reason of the presence of a

substantial number of deteriorated or deteriorating structures, defective or

inadequate streets, incompatible land use relationships, faulty lot layout in

relation to size, adequacy, accessibility, or usefulness, unsanitary or unsafe

conditions, deterioration of site or other improvements, diversity of

ownership, tax or special assessment delinquency exceeding the actual value of

land, property by fire or other causes, or a combination of such factors,

substantially impairs or arrests the sound growth of municipality, retards the

provisions of housing accommodations or constitutes an economic or social

liability and is detrimental to the public health, safety or welfare in its

present conditions and use; or

c)

An area in which

there is a predominance of buildings or improvements which by reason of age,

history, architecture or significances should be preserved or restored to

productive use.

The Governing Body has

also determined that the rehabilitation, conservation, and redevelopment of the

District is necessary to protect the public health, safety and welfare of the

residents of the Neighborhood Revitalization District and the City as a

whole.

The components

of the Plan include a map establishing boundaries of the District, a proposal

for improving municipal services, a list establishing local eligibility

criteria, and an application procedure for the Program.

The Plan provides an avenue

to achieve the City’s goal to improve neighborhoods to strengthen the City’s

reputation as a safe and friendly community.

Section

1: Purpose

Establish a neighborhood

revitalization tax rebate program (“Program”) to provide incentives for both

residential and commercial property owners to improve their aging or

deteriorating property, or otherwise increase the appraised value of the

property. The Program is intended to

promote the revitalization and development of residential and commercial

properties by stimulating new construction and the rehabilitation,

conservation, or redevelopment of the area in order to protect the public

health, safety, or welfare of residents of the City.

The purpose of

implementing the Program includes providing a revitalization tool that will:

- Stabilize mature neighborhoods by rehabilitating

older homes and properties.

- Encourage volunteers from non-profits to

revitalize areas and homes.

- Encourage property owners to improve businesses

and homes.

- Encourage improvement of rental properties.

- Strengthen community pride.

- Eventually increase tax base and make affordable

housing more available.

There are many

benefits of the Program:

- It will provide incentives for housing

improvements through property tax refunds.

- It does not interfere with current property tax

revenues.

- It will create new long-term tax revenue,

without creating a fiscal burden for the City, County, and other taxing

jurisdictions.

- It will offer incentives for development/redevelopment

where development/redevelopment might not otherwise occur.

- It will help create jobs because, historically,

jobs follow development.

- It will help reverse the outward migration of

residents and the resulting deterioration of neighborhoods within the mature

portion of the City.

- It will help stabilize land value.

- It will strengthen the fiscal capacity of city

government to grow and serve the area.

- It provides a window of opportunity for

participation, thereby, prompting investment that otherwise may not have

occurred.

- It will encourage housing, commercial, and industrial

development in the City.

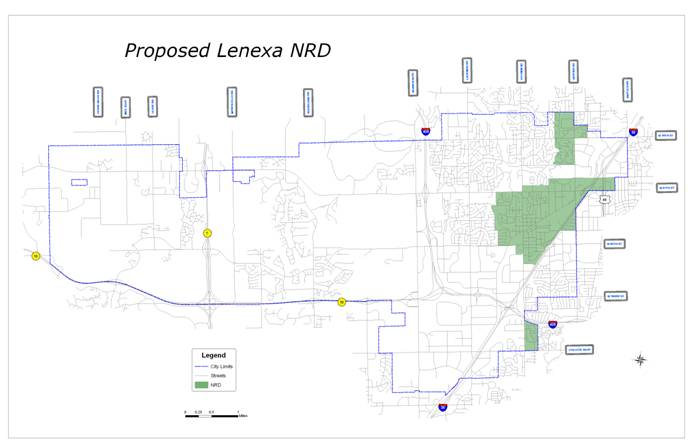

Section 2: Legal Description of Neighborhood

Revitalization District

Legal to be written once district is finalized.

Section 3: Value of

Real Properties

The appraised value

of the real estate in the District for the 3,644 parcels is:

Land: $ 173,275,840

Buildings:

$

658,099,525

Total Value: $ 831,375,365

The assessed

value of the real estate in the District for the 3,644 parcels is:

Land: $

Buildings:

$

Total

Value: $

Assessed value to be determined once district is

finalized.

Section 4: Owners of Record in the Districts

A list of

names and addresses of owners of record of real estate within the District are

available upon request from the City Clerk’s Office.

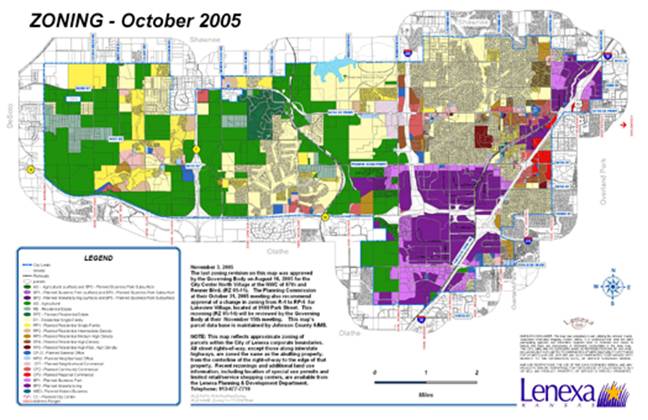

Section 5: Zoning Classifications and Land Use

See Appendix

II – Zoning Map.

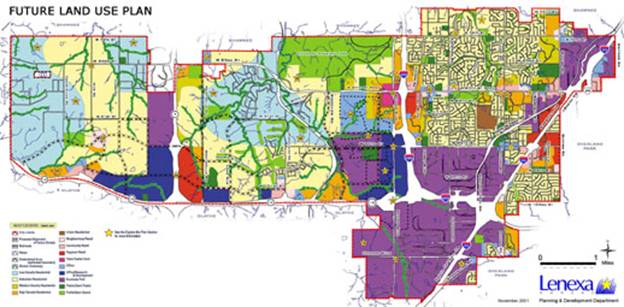

See Appendix III

– Land Use Map.

Section 6: Current Condition of the Districts

The 1,718 acre

District is comprised of single family, two family and multifamily residential,

commercial, retail and office park components. The split of parcels in the District is

approximately 71% residential, 7% commercial, 13% ROW, 6% common grounds/public

and semi public, and 2% agriculture or vacant.

Of the residential units, approximately 68% of the residential

properties in the District are single family units, 19% are duplexes and 22%

are multifamily units (including skilled nursing facilities). The businesses (commercial, retail,

warehouse, etc) comprise approximately 7% of the parcels in the District. The remaining 22% of the parcels included are

right of way, agriculture/vacant and common ground. The

Utilizing the

2000 Census information, the demographics in the District are below:

Average Household

Income: $48,900

|

Race |

% of District Population |

|

Caucasian |

82.2% |

|

African

American |

4.9 |

|

Native

American |

>1.0% |

|

Asian |

4.9% |

|

Hispanic |

6.2 |

|

Total |

100% |

|

Age |

% of District

Population |

|

>5 |

6.2% |

|

5-9 |

6.43% |

|

10-14 |

6.0% |

|

15-19 |

5.9% |

|

20-24 |

8.8% |

|

25-34 |

18.3% |

|

35-44 |

15.0% |

|

45-54 |

13.7% |

|

55-59 |

4.4% |

|

60-64 |

2.8% |

|

65-74 |

4.6% |

|

75-84 |

4.8% |

|

<85 |

3.2% |

|

Total |

100.0% |

Other

statistics reviewed include crime rates and code violations. Approximately, 15,156 crimes occurred from

2001 to 2005 of which approximately 4,825 or 31.83% occurred in the District. Of these, 1,009 or 20.9% were serious in

nature compared to 2,419 or 16% outside of the District. Code violations in the

District reached approximately 4,739 from 2001-2005 or 38% of the City’s total

violations.

Section 7: Proposals for Improving Municipal Services in

the District

The City

recognizes the value of municipal services and capital improvements throughout

the community. The City is strongly

committed to maintaining a substantial presence in the District.

Efforts

underway or in planning stages include:

Capital

Projects 2006-2010

Road Improvements

Community

Center HVAC and Fire Suppression Upgrades (2006)

Roof Replacement

on Parks Maintenance Shops (2007)

Watershed Improvements

77th

and Caenen Storm Drainage Improvements (2006)

Crime Resistant Community Program

The purpose of the Crime Resistant

Community Program is to help deal with illegal activity and quality of life

issues that occur in our hotels and apartment communities.

It addresses criminal activities such as illegal

drugs and loud noise complaints, and also addresses quality of life issues such

as abandoned vehicles that can lead to an increase in criminal activity.

Rental

Licensing and Inspections Program

A program other

communities have used to keep maturing residential neighborhoods strong and

viable is a licensing and inspection program of rental properties ranging from

single family homes to apartments.

Enhanced

Code Enforcement.

As neighborhoods

in

Section 8: Criteria for Determining Eligibility

Eligible property

applies to additions or improvements to existing buildings, new construction,

or both (“Improvements”).

1. There will be a five (5) year application period beginning January

1, 2007, and ending December 31, 2012. At the end of four

(4) years, the City will review the Plan and determine its continuation. The

City reserves the right to evaluate the Program at any time. Applications approved

during the five-year period will continue to receive the tax rebate for a full

ten (10) years following completion of the project

(“Term”.)

2. The Improvements must result in an increase of $5,000

for residential and $10,000 commercial or industrial in the appraised value of

eligible property within twelve months of making the Improvements. Some Improvements,

such as major repairs (even those that may require a building permit) may not result

in an increase in the appraised value and thus will not be eligible for a

property tax rebate.

3. New and existing Improvements on property

must conform to all codes, rules, and regulations in effect at the time the Improvements

are made. Tax rebates may be terminated if Improvements do not conform to codes

during the Term.

4. Any otherwise eligible property with delinquent taxes

or special assessments shall not be eligible for a rebate until such time as

all taxes and assessments have been paid.

5. Qualified Improvements eligible for tax rebates under

the Neighborhood Revitalization Plan may submit only one application per piece

of property. Unless approved by City

Council action.

6. Tax rebate is personal to the owner. If a property is

sold the tax rebate will be terminated.

7. The Program is subject to approval of each taxing

unit which will be stated in the interlocal agreement between the City and taxing

jurisdictions. (See the City Clerk for taxing units who have adopted the Program.)

8. Construction must be completed in the time set out in

the Program application. Extensions beyond that period will be considered on a

case by case basis by the Assistant City Administrator.

9. Property Eligible for a Property Tax Rebate

a) Residential Property

i.

Property used

after improvement for single or multi-family residential uses shall be limited

to: redevelopment (ground up), rehabilitation

and alterations, including new or existing accessory structures to any existing

primary residential structure built prior to adoption of this Plan, including

alteration of a single-family home into a multi-family dwelling, shall be

eligible.

ii.

The Improvements

must meet the minimum health and safety codes of the City.

iii.

Eligible

residential property shall be eligible for a 75-85 percent rebate of property

taxes on taxable value of eligible Improvements for the Term (see Section 10.)

b) Commercial & Industrial Property

i.

All property

used exclusively after redevelopment (ground up)

or improvement for commercial

or industrial uses shall be eligible.

ii.

Mixed use

residential and commercial property shall be eligible if the residential use

qualifies or to the extent the Improvements are appraised as commercial

property.

iii.

Mixed use residential

and industrial property shall be eligible.

iv.

Eligible

commercial and industrial property shall be eligible for a 75% rebate of

property taxes on the appraised value of eligible improvements for the Term (see

Section 10.)

c) Agricultural and all other property

Property used after

improvement for agricultural or any non-commercial, non-industrial or

non-residential uses shall not be eligible.

10. General Provisions Applicable to All Rebate

Applications on Eligible Property

a) Property owners of all eligible property shall make

application filed with the City Clerk on application forms provided by the City.

b) Eligible Improvements must be authorized by a

building permit when applicable.

c) Property owners shall make application before a

building permit has been issued and the permit fee paid for any eligible Improvements

(Building Permit fees is refundable if the project meets the requirements of

eligibility). The deadline for application shall be prior to commencing

improvements. The property owner may appeal to the City Council and the City Council

may approve an application for rebate after the deadline but not later than

when the substantially completed improvements are first assessed by a Lenexa Building

Official or designee.

d) Only one application for rebate shall be allowed per

property. This application may include any

number of Improvements.

e) Any otherwise eligible property with delinquent taxes

or special assessments shall not be eligible for a rebate until such time as

all taxes and assessments have been paid. If delinquency occurs after entry

into the Program, the owner shall have ninety days to bring taxes current. If such delinquency continues beyond ninety

days, the property shall no longer be eligible for the Program. If such delinquency is corrected within the

initial 90 days, but reoccurs in subsequent years, the property shall no longer

be eligible for the Program.

f)

The property

owner shall notify the City when all improvements covered under the application

have been completed and the City shall inspect the Improvements for compliance

with the required building codes. The

City shall notify the

g) The

h) The rebate shall be calculated each year using the appraised

value resulting from the Improvements.

i)

The property

taxes must be paid and an increment generated before a rebate will be issued.

j)

The Assistant

City Administrator shall review all applications based on eligibility contained

in this Plan and approve such eligible applications. If an application is not

approved, the property owner may appeal the decision within 10 days of the date

of the Assistant City Administrator’s decision, in writing to the City Council

for final determination.

k) If this Plan is repealed or the rebate criteria

changed, any approved applications shall be eligible for rebates for the

remaining Term of the rebate originally provided in the Plan.

15. Construction of an improvement must have begun on or

after the date of the designation of the District and be located within the District.

16. The appraised valuation must increase by $5,000 for

single family and two-family residential and by $10,000 for multifamily and

commercial property.

17. An application for a tax rebate must be filed prior

to commencing construction.

18. The Improvements must conform to the City of

19. The new, as well as existing improvements on the

property must conform to all applicable codes, rules, laws, ordinances, and

regulations in effect at the time the improvements are made, and remain in

compliance for the length of the rebate or the rebate may be terminated.

20. List of

Improvements NOT Eligible for rebate

- Swimming pools

- All property within a TIF

- Any property which has or will receive a tax

abatement

21. Effective Dates of the Plan

This Plan and

property tax rebates provided by this Plan shall be effective upon the adoption

of this Plan by resolution of the City Council of the City of

Section 9: Application Procedures

Prior to filing the

Application for Tax Rebate, the following procedure apply:

1. Obtain an application from the Lenexa City Clerk,

located at

2. Prior to the commencement of construction of any Improvements

or new construction for which a tax rebate will be requested, the

applicant-owner will complete Part 1 of the application. Requests must be

received and approved before commencement of construction.

3. Part 1 of the application must be filed with the City

Clerk with a refundable application fee ($25.00 single family residential and $100.00

multifamily residential or commercial) prior to the commencement of

construction.

4. The City will notify by letter to the applicant

within ten (10) days of receipt of a completed and comprehensive application,

indicating approval or denial of the project.

5. The City Clerk will forward a copy of Part 1 to the

6. The applicant-owner will notify the

7. For any Improvements that are only partially

completed as of January 1, following commencement of construction, the

owner-applicant will file Part 3 of the application with the

8. For any improvement that is completed on or before

January 1, following the commencement of construction, the owner-applicant will

file Part 3 of the application with the

9. Soon after January 1, the

10. Upon filing of Part 3, and the determination of the

new valuation of the said real estate, the form will be filed by the City Clerk

with the

11. Upon payment in full of the real estate tax for the

subject property for the initial and each succeeding year period extending

through the specified rebate period, and within approximately thirty (30) day

period following the date of tax distribution by the City to the other taxing

units, a tax rebate in the amount of the tax increment will be made to the

owner. The tax rebate will be made by the Finance Director of